Starting now through the next 5 months, appraisers will be out knocking on doors looking at anything new that was built this past year. From new single family dwellings, to additions, remodels, out buildings, and more.

Starting now through the next 5 months, appraisers will be out knocking on doors looking at anything new that was built this past year. From new single family dwellings, to additions, remodels, out buildings, and more.

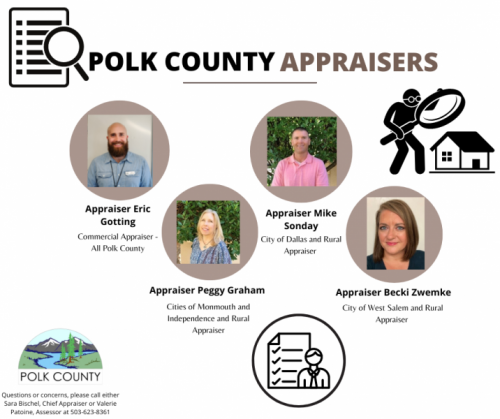

Click any thumbnail image to view a slideshow